Navigating the NFT investment landscape has undergone a significant shift. In 2020, it was a peripheral consideration in the crypto space, but within just three years, perceptions about investing in NFTs have drastically changed.

The current crypto market is undergoing a period that industry luminary Vitalik Buterin himself has labeled as the crypto winter. However, investors armed with a clear investment strategy are poised to withstand any market downturn in the NFT space and secure substantial returns over the long term. The NFTMetria team, drawing on extensive experience in both short-term and long-term NFT investments, is eager to impart our insights and knowledge through our NFT investor course.

But for those inclined to delve into the intricacies of investing independently, this article provides a comprehensive guide to NFT investment models, encompassing their valuation and the potential returns associated with such investments.

Investment vs Speculation in the NFT Space

One of the fundamental aspects for any investor is to establish clear rules for the game they are participating in. The primary objective is to grasp the distinction between investing and speculating.

As articulated by Warren Buffett, one of the wealthiest individuals globally:

If you are an investor, then look at what the asset will do, and if you are a speculator, then look at what the price will do.

Understanding the disparity between investing and speculating is pivotal for judicious capital allocation, and this is where missteps are most likely to occur. Many believe that flipping NFTs can lead to rapid wealth accumulation.

While some individuals may succeed, the majority do not. Achieving success in swift speculation often hinges on promotion and luck. If the right influencers are endorsing a project, its price can skyrocket. However, if you lack such influence, success in flipping becomes improbable.

Investing necessitates a long-term perspective focused on ascertaining the intrinsic value of an asset. Therefore, selecting your own market behavior model is crucial, and we delve into this topic in detail in our article on the TOP NFT investment strategies.

Models of NFT Investment Value Shaping Asset Price Growth

In the realm of NFT investment, there are three distinct games that investors can engage in:

- Future Distribution

- Utility

- Cultural Significance

These categories span a spectrum of investment approaches, ranging from purely financial investments to those driven by social currency.

The most successful NFT projects are those that effectively blend all three dimensions, where the value of future distribution is heightened by cultural significance and/or the utility of the work.

Future Distribution as an Investment Value Model for NFTs

NFTs that involve the distribution of other assets bear the closest resemblance to stocks in terms of the flow of “dividends.” For such projects, assessing the team and anticipating future cash flows is essential, akin to traditional equity investments.

NFTs can generate a dividend stream through various means:

- Income from Tokens,

- Royalty,

- Airdrops of New NFTs,

- Strength of a Centralized and Decentralized Project Team.

Income from Tokens

Certain projects distribute tokens to NFT holders, either as general-purpose cryptocurrencies or tokens specific to a particular environment, like a project’s DAO. A notable example is Yuga Labs, creators of Bored Ape Yacht Club (BAYC) that has introduced 1 billion tokens, allocating 8% for complimentary distribution among NFT holders from the BAYC and MAYC collections. BAYC holders were granted 10,094 ApeCoins (equivalent to approximately $80,000), while MAYC owners received 2042 ApeCoin (valued at about $16,400). These tokens are currently yielding substantial dividends for their recipients, all obtained without any initial expenditure.

Royalty

NFTs, rooted in smart contracts, allow for the embedding of conditions such as guaranteed royalty percentages for the original owner upon resale. Investing in such NFTs aligns with a traditional stock investment model, valuing the NFT based on discounted cash flow.

Airdrops of Other NFTs

Some projects distribute new NFTs to existing holders or offer privileged access to new assets at a discounted rate. Evaluating the potential value of these future NFTs becomes crucial for investors, often dependent on the cultural significance of the launching projects.

An example is Chiru Labs‘ successful use of airdrop for Beanz, exclusively for holders of the original Azuki NFTs.

Investing in a Centralized NFT Team

Beyond the value of distributed assets, evaluating the associated project team is crucial for investors employing an allocation strategy. The team plays a pivotal role in creating value through crypto asset distribution, profit streams, or enhancing the cultural significance of NFTs.

Investors should avoid projects with centralized teams if they lack confidence in the team’s capabilities. Recognizable teams include Pixel Vault (Punks Comic, Metahero), Yuga Labs (BAYC, MAYC, OtherSide), Larva Labs (Cryptopunks, Meebits), WeNeW Labs (10KTF), RTFKT (Clone X), and Sky Mavis (Axie Infinity).

Investing in the Decentralized NFT Community

Decentralized team structures rely more on the community for development, akin to a social rather than corporate approach. Strong communities benefit from creative returns, enhancing cultural value and benefiting NFT holders.

Investors should exercise caution when investing in projects with decentralized teams, considering the strength and potential of the community. An example is Dom Hoffman’s creation of Loot, a fantasy NFT project with a social structure that quickly garnered a robust community and introduced the primitive currency Adventure Gold (AGLD).

In conclusion, regardless of the type of future distribution, a savvy investor should exercise restraint when the discounted expected dividend falls well below the NFT’s current value, prompting a reassessment of the asset’s viability.

Utility as a Model for NFT Investment Value

Utility in the context of NFTs refers to the tangible benefits offered to token holders. While it is more straightforward to evaluate than cultural significance, it remains more complex than assessing future distributions.

The usefulness of NFTs manifests itself in:

- The digital world,

- The real world.

Digital Utility

Digital utility empowers NFT owners with specific advantages in the digital realm. These utilities span a broad spectrum, ranging from in-game NFT resources and memberships to ENS usernames.

In the digital landscape, gaming assets tied to NFTs seamlessly integrate into the broader internet ecosystem, retaining the advantages of provenance and tradability. Investing in NFTs with digital utility essentially bets on the continued growth of the crypto industry and, to a large extent, the expanding role of metaverses in human life.

Successful investments in digital utility involve assets that are scarce and irreplaceable, similar to real-world assets like domain names and land.

Examples from the Gaming and Metaverse Realm

Innovative developers are introducing games and metaverses centered around NFTs:

- Crypto Raiders: An RPG game where players purchase characters, and each character, represented by a unique blockchain token, can face consequences, such as death, creating real stakes in the game.

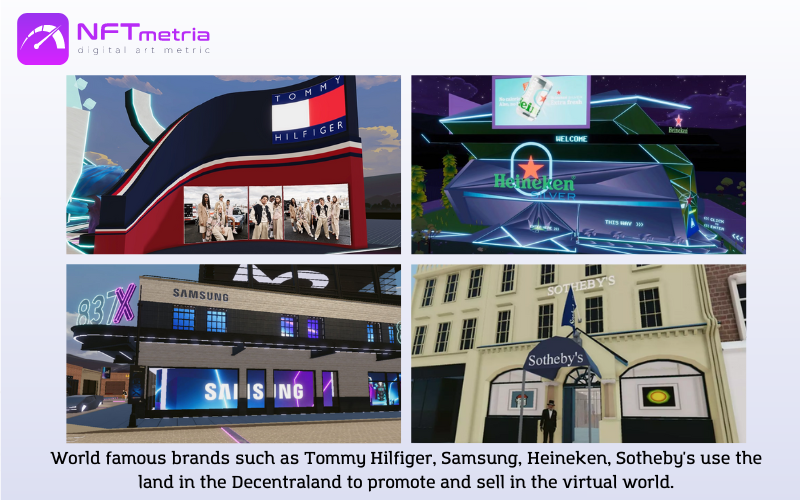

- Virtual Lands in Decentraland and The Sandbox: These constitute another form of digital utility. NFT collectors acquire land for various purposes, from displaying NFTs in galleries to building businesses. Sotheby’s has a gallery in Decentraland that does both. Also, for example, Gucci and Adidas are represented in Sandbox, and Decentraland has such brands as Samsung, Coca-Cola, Domino’s.

Example from the World of ENS

ENS domains exemplify pure digital utility, providing memorable domain names for crypto wallet addresses. Instead of a complex wallet address “0xc4779fAFAeaA2c16a70DcE53B68DD5E171f0a281”, you get an ENS domain nftmetria.eth. ENS domains, being NFTs, not only offer functionality but also carry collectible value due to their traceable movement history.

Real Utility

NFTs with real-world utility confer specific benefits to owners in the physical world, often working best with issuers possessing established brands. Investing in real-world utility requires a deeper understanding of niche communities rather than a broad comprehension of something tangibly useful, like a domain name.

Examples

- VeeFriends by Gary Vaynerchuk: This project offers three kinds of utility: Access (providing owners access to Gary for activities like lunch or tennis), Gifts (sending cool items to token holders), and Login (granting access to participate in the VeeCon NFT conference).

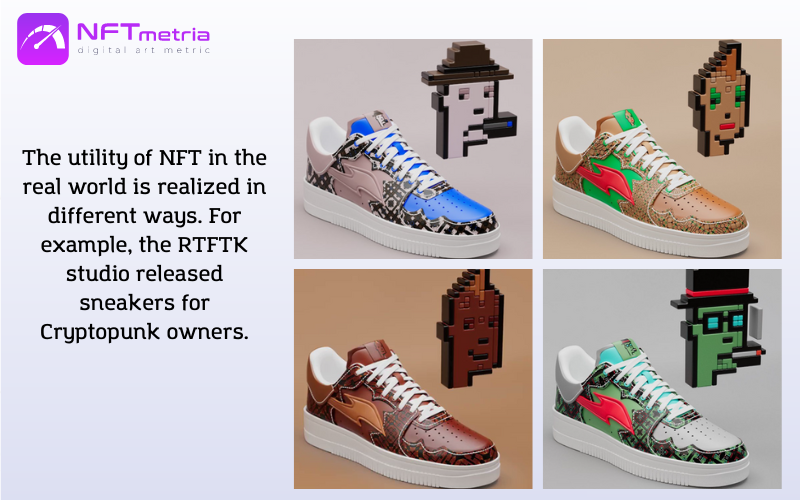

- RTFKT (Owned by Nike): Collaborating with artists and designers, RTFKT focuses on delivering unique streetwear-focused products, creating specialized items for CryptoPunks wearers and partnering with renowned streetwear designers like Jeff Staple.

Cultural Significance as a Model for NFT Investment Value

The ownership of culturally significant assets has perpetually been a symbol of status, with the utility of such assets lying in the expression of identity.

Identity, being intangible, holds immeasurable value, transcending specific cash flows from any given individual. The intangibility of cultural relevance often divorces NFT prices from the rational expectations of future distributions. In essence, culturally significant items tend to gain more importance as their value increases.

Cryptopunks, trading at over $300,000, exemplify this phenomenon. Their cultural significance has grown partly due to their escalating prices. Investing in Cryptopunks hinges on the belief that their importance will continue to surge over time.

Money makes things more meaningful, whether you like it or not.

Engaging in the cultural significant arena involves wagering on the growth of an NFT’s significance. As the cultural importance of an asset ascends, so does the desire for ownership, leading to a surge in prices, particularly if the asset is scarce.

Cultural importance derives from four factors:

- Artist,

- Aesthetics,

- Narrative,

- Community.

These four elements can be evident independently, yet enduring cultural significance frequently arises from the amalgamation of all four.

These factors are inherently interconnected. Every distinguished artist possesses distinctive aesthetics, and communities that appreciate aesthetics as an exquisite form actively endorse it.

History can exist independently since it is unalterable.

Artist

The artist functions as the brand, imparting value to their work.

Acquiring artwork from a renowned artist parallels buying a Louis Vuitton handbag; the name carries weight. Over time, artists gain cultural relevance, particularly in the early days of NFTs where pioneers made a mark among crypto enthusiasts with substantial cryptocurrency holdings.

Early NFT artists, selling pieces at record prices, achieved cultural significance that persists. Investing in artists involves a choice between established figures, akin to blue-chip stocks, or undiscovered talents, resembling venture capital.

Investing in a well-known artist is a wager on the increasing value of their work, a straightforward proposition. According to the Lindy effect, the longer an artist stays relevant, the more likely they are to endure in relevance, a crucial consideration in the rapidly evolving NFT space.

Investing in an unknown artist is a bet on their breakthrough. In such cases, identifying artists utilizing novel techniques to create meaningful art is key. Investing in the 1,000th generative artist could be successful if their work captivates, but backing an artist on a new platform or using innovative technology might be more promising.

Examples:

- Beeple, arguably the most renowned NFT-era artist, achieved a milestone by selling “Everydays: The First 5000 Days” for $69 million at Christie’s.

- Crypto artists like XCOPY and Hackatao consistently sell unique pieces for hundreds of thousands of dollars.

- Platform choice also influences early relevance; while Ethereum is a common choice, artists on blockchains like Solana or Tezos, such as jjjjjjjjjohn, command significant prices.

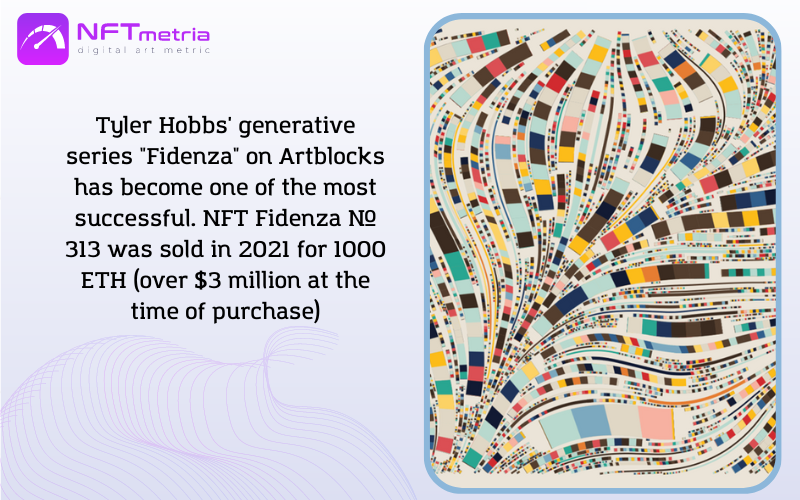

- Generative art, created through algorithms rather than manual drawing, has gained traction. Tyler Hobbs‘ “Fidenza” series on Artblocks stands out as one of the most successful examples.

Aesthetic Appeal

While beauty is subjective, its value remains a universal constant, evoking emotional responses from observers and carrying an intangible worth.

Sustainable and increasing value arises from a blend of history, brand, and beauty.

Conversely, an artist with a robust brand may struggle if their art lacks visual appeal. Beauty, though subjective, plays a crucial role. Your inner sense of beauty becomes paramount in evaluating artistic value. Trust it.

Narrative

A distinctive feature of blockchain enhancing the potency of NFTs is the comprehensive record detailing the journey of an asset from its inception to current ownership, referred to as origin.

Given that most NFT-supporting blockchains (such as Ethereum, Solana, Tezos) are relatively new, recent history may appear ancient. Robust collector communities have formed around assets linked to specific events in the history of these networks or the NFT market in general.

Examples

- Cryptopunks, considered OG NFTs, hold historical value, and other projects share this significance.

- My Curio Cards, a collection of 30 digital trading cards from 2017, predating Cryptopunks, boasts rare cards selling for hundreds of thousands of dollars.

- PixelMap, a 2016 project allowing ownership of pixels on a map, has recently regained attention, with current sales around $10,000.

Both of these projects will remain significant, but it will be difficult for them to compete with the Cryptopunks or BAYC in terms of cultural influence. The artworks and artists lack compelling elements, resulting in comparatively weaker communities.

Community

The most influential aspect of cultural significance is the community.

While artists, aesthetics, and history provide foundations for community building, an NFT’s cultural significance relies heavily on community support. Effective promotion of any NFT involves communication and the establishment of a robust community.

Nearly every new NFT project begins with an organized community on platforms like Discord, where creators strive to engage a specific audience. The best projects boast communities that thrive independently, while unsuccessful ones have lifeless communities where interest is absent. When investing in cultural significance, the activity of the community on platforms like Discord, Twitter, and Telegram serves as a crucial indicator of a project’s sustainability.

Communities can be structured or unstructured.

An organized community gives rise to cultural significance, while an unorganized one reinforces it. When a community extends beyond its initial boundaries, it becomes a litmus test for its importance.

Projects adept at managing this transition demonstrate resilience, while those that fail remain confined to niche status.

Examples

- Organized communities – Projects like Azuki or Clone X feature highly engaged communities actively discussing various development directions on Discord.

- Unorganized communities – Cryptopunks, for instance, lack an official Discord community, but camaraderie exists among Cryptopunks on Twitter. Punks communicate and show mutual interest. Similarly, BAYC members maintain a disorganized yet cohesive presence in the social realm.

Conclusion

In conclusion, navigating the intricate landscape of NFT investments involves understanding and strategically leveraging various models for assessing their value. The dynamic interplay of factors such as future distribution, utility, and cultural significance creates a multifaceted environment for investors. Future distribution models, resembling traditional equity investments, rely on evaluating teams and projected cash flows. Utility models underscore the tangible benefits an NFT offers, be it in the digital or physical realm, anchoring the investment in the growing influence of the crypto industry and metaverses. Cultural significance, a powerful driver, thrives on the synergy of the artist, aesthetics, story, and community, emphasizing the role of community in sustaining an NFT’s cultural relevance. As the NFT space continues to evolve, astute investors will find success in aligning their strategies with these diverse models, recognizing the nuances that contribute to the value and significance of these digital assets.