Have you recently been inspired by the huge potential of investing in NFTs and want to give it a try? Or are you already an experienced classic crypto investor, but lack specific knowledge in the NFT industry?

Either way, before you get started, you need to take the time to learn the ins and outs of investing in digital art. There are many courses on investing in NFTs. But will each of them give you really fundamental and relevant knowledge, tools and mechanics? Often, only the owner of the course wins and earns in investment training, and not the students. Doesn’t sound like much, right? So, we, the NFTMetriya team, destroy the most important fear of potential investors and give you a methodology that will always keep you in the black.

What is the advanced NFT investor course about?

In this article, we will review all the skills and abilities that you should have in an overview. And the NFT course itself is richly filled with basic and relevant, theoretical and practical knowledge. After a deep dive, you will not just be a player in the market, but will become an expert in the field and will make really good profits from investing. After all, this is what you plan to invest for, right?

And also in the NFT course:

- We will analyze the main technologies, tools and specifics of the industry,

- We will form an understanding of how the market works,

- We will tell you what analytical tools you will need as an NFT investor,

- Define profitable investment strategies,

- Consider NFT as an investment object, as well as how to choose a collection and within it a token for investment,

- Assess possible risks and potential profitability,

- Let’s analyze specific successful and unsuccessful cases for investing on the example of the real market.

Now let’s take an overview of all the key modules of the advanced NFT course.

1. Basic NFT technologies

Is it possible to successfully invest in something you don’t understand? We have seen many examples on the market and we can say with confidence – no, you can’t.

It is also like being treated by a doctor for a headache without knowing how the whole body works and without understanding the relationships and possible causes of the headache. So, the NFT market is also a global constantly working organism in which everything is interconnected. And you, as an investor, need to understand the underlying structures in order to make successful trades. Therefore, of course, we start the NFT training course with the basic concepts.

Blockchain

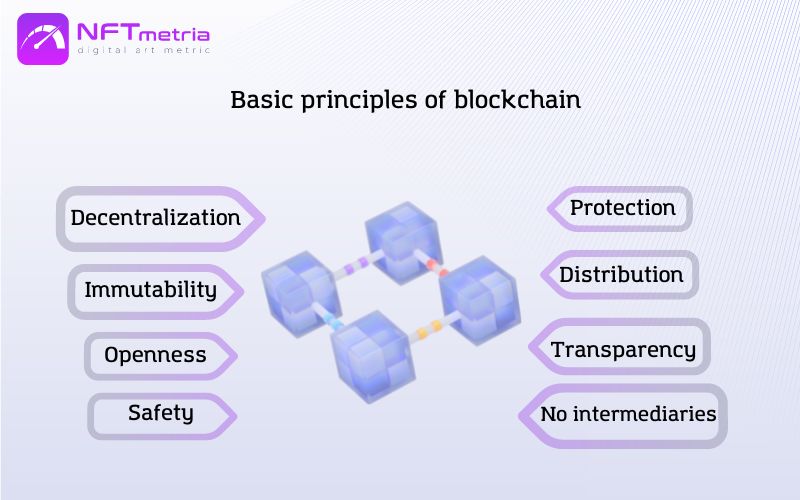

Blockchain literally means a chain of blocks. Each block in the chain contains information and is linked to the previous block. You can think of a blockchain as a huge database that is not located in one place, such as a city archive, but is distributed over the network. Since the blocks are interconnected, the information in the blockchain is almost impossible to change after the fact. Because each block contains part of the information of the previous block.

Blockchain was conceived as a new, more secure and transparent way to transfer data, which is decentralized and does not require an intermediary.

Since the blockchain contains open data, it is a very effective tool that should be used to analyze the behavior of players and monitor the activity being made. There are many information markers that you can use to confirm the hypotheses of your investment strategy.

Today, there are more than a dozen different blockchains. Among them, the giant and already a veteran of the Ethereum cryptocurrency market stands out. It has both undeniable advantages and vulnerable disadvantages. It was by emphasizing such shortcomings as low speed and high cost of transactions that other blockchains appeared. Among the most competitive at the moment, we can distinguish:

- Polygon,

- Binance,

- Solana.

You can invest in NFTs on any of the existing blockchains. But there are “pitfalls” that you are unlikely to find just in articles on Google. But we talk about them in our NFT course.

Smart contracts and NFT standards

We have already said above that blockchains work without intermediaries. But how? It’s all about smart contracts. It is a blockchain program that automatically ensures that certain actions are performed when predetermined conditions are met. Therefore, the human factor is minimized here.

In addition, smart contracts have other advantages:

- They facilitate transactions in a trustless system by allowing unfamiliar parties to interact without having to trust each other.

- They are immutable and cannot be edited once posted, providing greater security.

- Smart contracts hosted on the public blockchain are transparent and viewable by everyone.

- They are deterministic and perform only programmed functions.

For smart contracts, several standards have been developed for convenient interaction of NFT with applications, as well as for synchronizing tokens from different blockchains. Today, there are two standards for non-fungible tokens:

- ERC-721

The very first and traditional standard. According to ERC-721, all tokens must be non-fungible and have unique identifiers – a requirement that other standards may not comply with.

- ERC-1155

The ERC-1155 standard is currently used in the main gaming industry. It was created so that it could use both fungible assets, such as in-game currencies, and non-fungible assets, such as limited-edition skins.

We talk about what opportunities smart contracts provide, as well as their vulnerabilities, their use in the metaverses and why the importance of the NFT standard is important when investing, we talk in the corresponding module on our NFT course.

Types of NFT

We also advise you to make a basic decision about the type of NFTs you plan to invest in. You can, of course, start from personal preferences and hobbies, but then it will be your another new hobby, not an investment.

To date, we distinguish the following types of NFT:

- Digital Collections (For example: Top Collections),

- Collectibles (For example: the top most expensive NFTs),

- Domain names (ENS),

- Game items (For example, the TOP NFT games),

- Sports,

- Participation in the Metaverses (For example, the Top Metaverses),

- Membership NFTs as access to various online and offline communities and their privileges,

- Music,

- Photography.

Each type of NFT has its own investment potential, limits of use and applicability. Therefore, the investment strategy, and potential profitability, and the level of risk in investing differ.

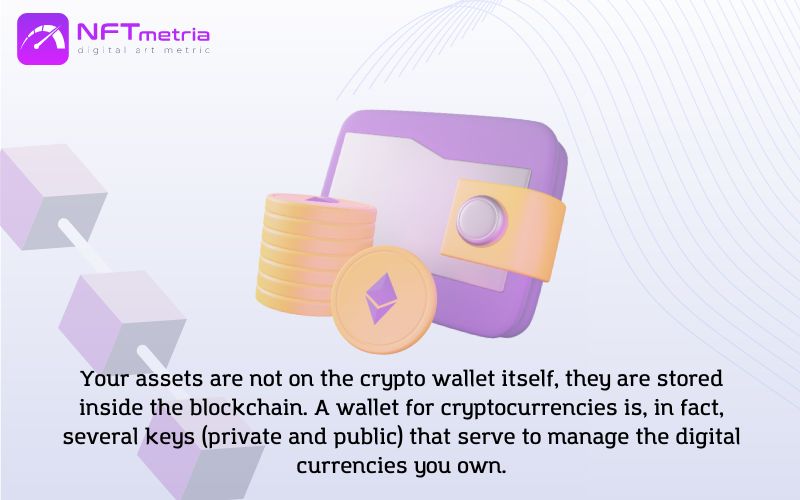

Crypto wallet

A crypto wallet is a must-have tool that is essential to participate in this fast-growing niche. It is through him that you will make all transactions, pay commissions for transactions and store tokens and currency. There are more than two dozen different wallets to choose from today. But is everyone safe and universal? Of course not. We, the NFTMetria team, conducted our own expert in-depth analysis of all offers on the market. And we, of course, share this knowledge in the NFT course.

Safety

The NFT industry has revolutionized the crypto market over the past couple of years. And after multi-million-dollar investments and profits, billions of dollars in sales, thousands of members and followers of the community, of course, a lot of scam came. For example, even top influencer Pranksy was scammed out of over $300,000 in just half a day.

Learning from your own mistakes in terms of security can be very, very expensive, and this is definitely not the path that will lead you to success. Therefore, the best solution is to get a digital security guide to protect yourself as much as possible from all sorts of scams, social engineering deception methods and phishing attacks.

Let’s share just a few tips:

- Download apps and NFT wallets only from official websites and app stores. Check the validity of digital signatures and certificates.

- Back up your original phrase in a safe offline location and never enter it on any website after the initial setup.

- Always bookmark the NFT browser applications you visit to avoid becoming a victim of phishing websites.

- If you are using a wallet offered as a browser extension, always remember to lock or log out before shutting down your computer.

- Do not use public computers to interact with the NFT. If necessary, be sure to delete all data before logging out.

Thanks to the security module included in the NFT course, you will learn:

- Oppose dangerous content,

- Identify scam projects and understand their promotion methods and typical gimmicks,

- Thoroughly check the project before investing in it,

- Understand the essence of interactions with smart contracts to prevent undesirable consequences.

2. NFT market

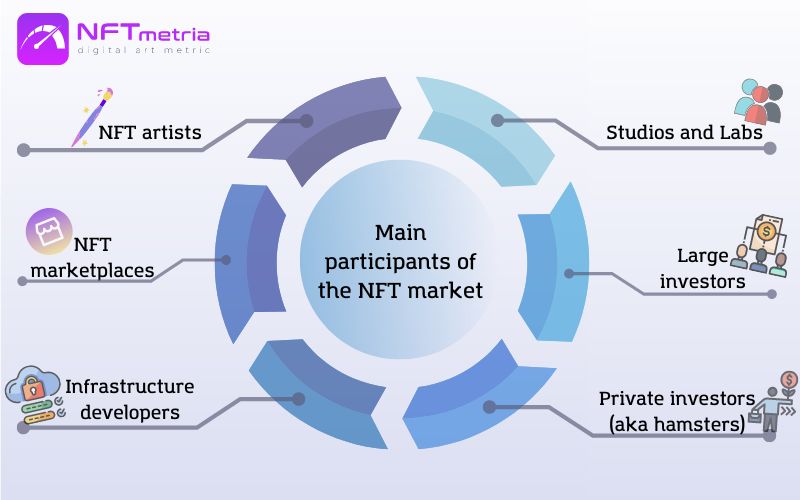

Liquidity, organicity, trends and market growth are not created by themselves. They are created by its specific members. Among them are both institutional and private representatives. A lot will depend on the depth of your knowledge in this topic. For example:

- You will understand the purpose of this or that action of each market participant,

- See a possible strategy of behavior in the market,

- Capture various social signals,

- Systematize the various hidden relationships of players,

- Understand the realism of the advertising slogans of large players, based on the actual behavior of the player in the market, and not on his words,

- To see an artificial increase in the liquidity of a particular project, as well as paid promotion, which is usually followed by a sharp decline in the investment attractiveness of the project.

And now we offer a look at the main market participants, as well as their interests, goals and strategies.

-

Marketplaces

Their main goal is to form the entire market and trends on it, increase market coverage and subsequent sales. For trading floors, a constant progression in the growth of buyers, sellers, internal sales, capitalization is important. It is on these parameters that various ratings are conducted.

But it is worth remembering that behind the various giants there are real people who, thanks to the coverage of the site, can influence the media and promote the projects and artists they need.

Read a detailed review of trading platforms in our article Top NFT Marketplaces.

-

Developers of infrastructure solutions

For example, there are crypto wallets, blockchain technologies, metaverses, etc.

Their main goal is to create infrastructure for the market, new niche solutions.

The development of this market share is provided by the money of large investors. With the right choice of trend and product concept, they can influence the industry as a whole.

-

Studios and Labs

Their main goal is to create an explosive and in-demand product that will create or support the company’s brand. This strategy always works successfully. Take, for example, Yuga Labs. After the creation of the BAYC collections and the entire accompanying infrastructure of the project, the brand name is now forever associated with success, profit and exclusivity. Each of their next project is doomed to success. And, accordingly, successful studios have a fairly large influence on the industry, setting trends.

Read a detailed overview of the largest companies and studios in our article Top NFT Companies.

-

Artists

Their main goal is the formation of a personal brand, which will ensure public attention and sales revenue.

The development of artists is possible, as a rule, through investments in marketing, the creation of their own community. Few artists have an impact on the industry as a whole. And in parallel with the formation of the market, the barrier to entry into the tops of this category is increasing.

Read a detailed overview of the most successful NFT artists in our article Top NFT Artists.

-

Large investors

Their main goal is to find a promising project at an early stage, invest in it, and receive high dividends in the future.

Such investors can invest both in projects and in promising studios and developers. And in this case, we are talking about such investors who have risk managers, analysts, as well as a well-thought-out trading strategy.

-

Private investors (aka hamsters)

Their main goal is to make a profit from investing. Within the framework of the entire market, their investments are minimal. A private investor is not able to significantly influence the market without mass association of “colleagues in the shop.”

Most private investors do not have a well-formed trading strategy and risk management strategy, do not understand the market, do not know how to use objective data to make rational decisions.

As you understand, it is in these omissions that your potential lies. You have the opportunity to become one level above other investors, having unique knowledge of the NFT course.

3. Analytical tools of NFT investor

In order to make rational and informed decisions, you as an investor need analytical tools that will help you easily read the action chains of various market players.

Ask how to do it? And here we recall the very first point – the blockchain. In it, all data is transparent, all transactions and operations that you can analyze in the clear are visible. Manually searching for all link chains is too time consuming and not always effective. Of course, it is better to use various analytical tools:

Liquidity assessment tools

In our NFT course, we provide only modern analytics tools that comprehensively evaluate the entire history of transactions across the entire collection. And also evaluate the relationship of holders. By the way, this data allows you to identify clusters of interrelated project participants and allows you to analyze their tactics and possible behavior in the market.

When identifying large clusters of wallets, you can more or less predict their future behavior and see the artificial creation of scarcity. So, you will form early entry points into the investment object. Using a similar tactic, you can determine the most efficient entry and exit points by matching the asset flows in the market with its liquidity.

Assessment of social signals

The NFT industry is about the community and public reactions. Without a comprehensive analysis of building a community around the project, you will not be able to assess the prospects of the project. The activity and the number of followers form the status, image and support of the project. There are some social signals by which you can evaluate the adequacy, activity of the community and its impact on the development of the project.

Despite the fact that social activity indicators can be easily cheated today, in the module on investor NFT analytical tools, we provide tools that will allow you to see the real social indicators of a potential investment project.

Rarity models

Why do some unique tokens sell for millions of dollars, while others cost much less? There is only one answer – a rarity.

Various rarity tools help the investor to assess the rarity, which are really needed in the arsenal of a competent investor. But there is a minus – they do not take into account market trends, usefulness, prospects and many other investment parameters.

Therefore, the use of analytical tools is only possible in combination. On their own, they won’t really give you the full picture to make a far-sighted decision.

4. Investment strategies

In the digital asset market and among the numerous NFT training courses, you can find a lot of strategies that can be used to make money on non-fungible tokens.

Before proceeding to a detailed study of strategies, we advise you to determine for yourself:

- Investment period (you will go long or you want to exit the position in 1 month),

- Starting investment amount (some projects have a high entry threshold, but the profit is also proportionally higher),

- The nature of the risk (the higher the potential return, the higher the risk),

- How deep are you willing to dive into the topic (investment for your main job or additional income, for which you devote up to 10 hours a week).

The answers to these questions will also be decisive for you when choosing a trading strategy. But are they all working and profitable? Of course not. Analyzing historical data and current trends, we have identified several strategies that have a positive vector of profitability. And on their basis, you will be able to formulate your personal strategy that will satisfy you in terms of timing, risks and return on investment.

5. Risk management in investments

In our NFT course, we have allocated a full-fledged module for this topic. This topic is extensive. Here are some of the many aspects:

- Types of investment risks (local, global).

For example, insufficient identification of the creators of the project (and sometimes its complete absence) makes it possible for scammers to scam on such projects.

Or, for example, the cost of Bitcoin correlates with the NFT market, and this should not be forgotten.

- Analysis of the origin of funds from the counterparty

When making a transaction, you, as an investor, need to analyze the legality of receiving funds on the counterparty’s account. To do this, using certain services, you can check the owner’s wallet for the risk factor. Why is it very important? If you bought NFT from a wallet with ill-gotten funds, then your transaction may be challenged and your assets frozen.

- Diversification of the investment portfolio

This is talked about a lot in the topic of investing, but we have prepared information for you specifically on the NFT industry. As you can see, there is absolutely its own specificity.

6. Real examples and cases

We know and understand that any large amount of information is hard to digest, if we talk only in theory without practice. Even if you speak in the most accessible and simple language. Therefore, our advanced NFT course includes comprehensive real-life examples of each module described in the article. And from our side, each example is supported by:

- historical data,

- causal relationships,

- social signals,

- options for solutions.

Agree, when you see real-life successful and failed examples in the crypto market, it is easier to navigate and apply the theory in practice.

And we are not only talking about CryptoPunks and BAYC, which everyone already knows about. After all, there are a lot more collections, non-fungible tokens, artists, investors and whales than you are used to hearing.

And also in this module of the NFT course for investors you will be able to:

- Extrapolate historical data to current projects and assess investment attractiveness,

- Finally see real investment opportunities in this market based on current case studies,

- Build your investment portfolio based on your goals, strategy, budget,

- Understand how to properly diversify based on crypto wallets of successful investors (learning from the best, remember?).

Warning

Remember, investment activity is associated with a high risk, and even more so investment in innovative objects such as NFTs. It is also worth considering that investments in NFTs are not investments in securities and other classic investment methods. Accordingly, they are not controlled by financial regulators such as FCA, SEK.

Passing this NFT course does not guarantee a return on investment. Due to the high risks in this industry, during training, we pay special attention to working with risks and evaluating investment objects.

The decisions you make on the basis of the information received will be your independent investment decision, for which the NFTMetriya team is not responsible.

Conclusion

Many novices’ investors dream of getting rich quick. It is important to keep in mind that this is unlikely to happen. As with most things in life, it takes a lot of work and practice to be successful.

Yes, it didn’t seem to you that the NFT market is vast, multilateral and ambiguous. Here the youth and the formation of the industry leave their mark. This market is only a few years old. And those investors who are able to separate media noise and baseless criticism from real sources of income are already earning very tangible money today. Want also? It’s absolutely real. And the proof of this is our students who have already been trained.

We, the NFTMetria team, have accumulated all our extensive experience and unique knowledge. As a result, we have developed the most fundamental and detailed NFT course on the market, which includes all the aspects that we touched on in the article.

Note that we do not weigh down the information, which is already quite a lot. We present all technically complex information in the most accessible language. Thanks to the knowledge gained, you will save a lot of personal time and raise your own expertise to a level above other private investors in the NFT industry. Try with our team to convert all your potential and desires into a really working investment technique.