How to start investing in NFT? Did you also ask this question? The cryptocurrency market is expanding and growing on a large scale. And the concept of the NFT market, non-fungible tokens, is logical in this vein. You understand that it is unlikely that global corporations, world-famous brands and public figures would invest tens of millions of dollars in a big soap bubble.

Although NFTs have been around for a few years now, there has been a huge surge in interest in the market after multi-million dollar sales and near-random fortunes. If you are thinking about investing in NFTs, then we have a wealth of information you need to know, such as the NFT World Investor’s Guide, as well as NFT investment strategies. And in this article we will talk about the very start: how to understand that you are ready to start investing in NFT ?

-

Set your goals and financial limits

While it’s easy to get carried away with the crypto frenzy, before embarking on any investment journey, you need to carefully examine your finances and determine your personal limit. You will think that we are talking about an analogue with a casino. But it is not. Investing in NFTs is a well-planned strategy with a rational approach and deep analysis. But for yourself, you should immediately outline the boundaries of what is permitted. Remember that any investment you make must be in the amount that you are willing to lose.

Beyond the limit, ask yourself why you want to start investing in NFTs. It is necessary to choose the right investment strategy for you.

There are many options for goals:

- stable good income to leave work,

- understand how this market works in order to issue NFTs yourself,

- close personal financial obligations,

- join the community and community of the NFT market,

- learn the art of investing, and so on.

Once you have determined exactly why and how much you can start investing in NFTs, you may want to consider investing in NFTs.

-

Assess your risk appetite

Before you start investing in NFTs, be sure to ask yourself what level of risk you consider acceptable. This ties in with our previous point about knowing how much you can comfortably lose and spending within that range.

Investing in NFTs is a high-risk investment.

Non-fungible tokens are a very volatile currency. If you decide to use them to create a stable passive income for yourself, or you are on a tight budget and are looking for a way to increase your wealth with minimal risk, then you may want to consider more stable investment methods such as index funds, pension plans, or high-yield savings accounts before start investing in NFTs. In addition to NFTs, there are also NFT cryptocurrencies, you can also start investing in them, but it also requires specific knowledge and understanding that these are high risks. You can read more about the best NFT coins today in our article TOP Best NFT Coins.

-

Get serious about safety

The society goes to blockchains and DAOs for the security of transactions, the absence of crime and theft. And Web 3 is really about security in its concept. But do you ever see regular news that again someone’s wallets were robbed of millions of dollars? And this is not a bad wallet, or a marketplace, or a blockchain. You can become a victim of phishing or any other fraud only through your own carelessness and negligence. Never install or download files you don’t know, don’t follow unfamiliar links.

We don`t advise you to brag about your income from the crypto industry, so as not to attract undue attention to yourself. A competent investor begins investing with a question about the security of his investments and future income from them. Therefore, use a proven and industry-proven crypto wallet.

Never store NFTs or cryptocurrencies on any public address that is not yours alone.

-

Become an NFT Expert

Never invest in something you don’t understand.

Why are there few truly savvy investors relative to other types of investment in NFTs? The first barrier for investors is information labyrinths and dead ends. Many people issue, sell, and advertise NFT, but few talk about this market. And we are not talking about pseudo-specialists who only want to make money on gullible people. We are talking about the institutional deep understanding of the market. And this is not only the knowledge of major players: artists, companies, marketplaces. For those who understand the technology from the inside, a broad understanding of the market opens up. What is blockchain , smart contract, token standards, NFT currencies, volatility and so on – all this you need to know and understand.

Understanding how the technology works will help you understand each individual blockchain and the value of NFTs. Without a storehouse of knowledge, you will not be able to distinguish between a hopeless picture and a brilliant collection with a promising future. And besides this, not knowing the features of blockchains, marketplaces, NFT currencies, you may also encounter difficulties. Because when you bet on NFTs, you are also betting on a currency that helps power the decentralized network that hosts it. You can read about what is inside the NFT and how they are technically arranged in our article How NFT works from the inside? We understand the stuffing.

If all of the above parameters did not make sense to you, then you need to do additional independent research or join us for a new stream of the author’s course about NFT.

-

Find your niche in the NFT market

In continuation of the previous topic: after a deep understanding of the subject of investment, that is, the essence of the NFT, you need to find your niche in the entire diverse market. Think about how your hobbies, real life, work can help you understand the psychology of buyers in a particular segment. You need to understand what people are interested in, what they like and why they are ready to buy a certain collection, as opposed to another similar one. And in doing so, this psychology should resonate with you. What is close to you?

There are many types of NFTs:

- Collectible art at Rarible,

- The best NBA shots on the sports marketplace NBA Top Shot,

- Various games, such as Axie Infiniti,

- Domains, access to various events and lands in the Metaverses on OpenSea,

- Crypto art on SuperRare,

- Conceptual avant-garde art at Foundation.

While the major NFTs of the big players in the NBA Top Shot are currently very expensive, you may know in basketball the obscure but promising players who could be the next LeBron James. Then you buy them cheap and sell them later at the peak. It’s like betting on a good startup. The same goes for any NFTs.

Once you know how NFTs work, you can blend that knowledge with your own interests to benefit from a unique insight into a market niche.

-

Choose authors, not NFTs

They say you should pick good companies, not good stocks. This can be applied to NFTs as well.

If you find an artist who is constantly releasing what you consider to be high quality and promising work, but who has not yet achieved the fame of Beeple or Pak, then you may have found a jackpot. Pick up a few of his works in order not only to support the author, but also to make a firm bet on the future.

Here are some more tips:

- take a closer look at the artists whose style of work you like,

- do not fall for the frills to buy a cheap imitation of famous NFT collections if you decide to invest in the name of the artist;

- determine what elements attract the attention of buyers and collectors,

- don’t focus on just one author, be open to new ideas.

-

Follow the market

This, of course, should be the number 1 point for those who are thinking about starting to invest in NFTs. You need to be regularly up to date with the entire blockchain industry, the cryptocurrency market, and the NFT space in order to be able to not only capitalize on opportunities, but also prevent potential setbacks.

This doesn’t mean you have to read cryptocurrency news 24 hours a day, but investors in this space would do well to set aside some time to study it regularly and, by extension, their money.

-

Don’t be a hostage to FOMO

Have you ever heard the phrase:

Don’t try to catch a falling knife.

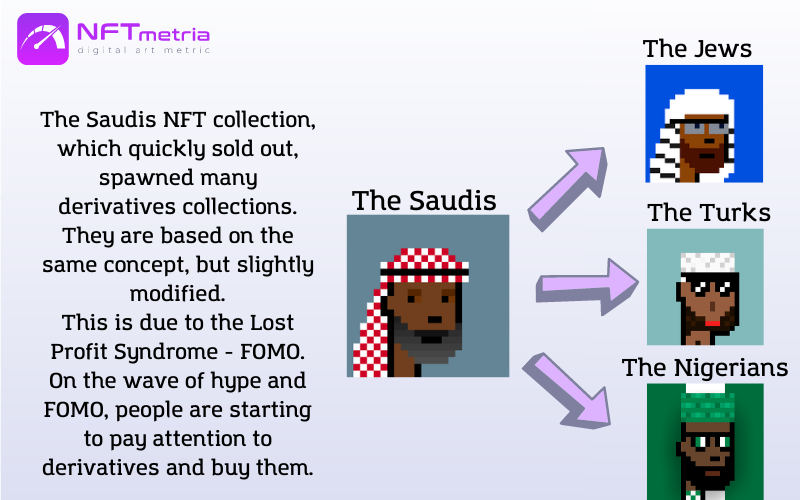

Let’s start with definitions. Derivatives in the NFT world are fake parody collections. It’s better to give an example. There was a collection of The Saudis, it shot and after that her derivative collections appeared, which are based on the same concept, but with some modifications: The Jews, The Turks, The Nigerians, The Italians, Saudis Billionaire. But you probably have a question in your head: who will buy such creativity that is not original in nature?

And here we will start talking about the syndrome of lost profits – FOMO. The fact is, when people see that the collection has taken off, and someone else was able to make money on it, they begin to reproach themselves for inaction in the past and try to correct the situation with all their might. Therefore, they often make irrational decisions. On the wave of hype and under the influence of FOMO, people are starting to pay attention to derivatives. And what is most surprising, such collections are sold out and give X’s.

Therefore, if you are a founder and you see that there is a lot of talk about some collection, then you can make money on it. In this case, it is important to quickly respond to the surrounding reality.

Well, if you are an investor. Know that this gives X’s. The main thing is not to fall for a scam collection under the influence of FOMO, which will steal all the tokens from your wallet.

Make every decision with patience and never rush. basic idea!

-

Don’t lose sleep

After all, the purpose of investing is to help increase your money so that you can live safely and comfortably. If your investments keep you awake at night or you are constantly following the news from the world of NFTs and blockchain, then you have misaligned your decision making with your risk appetite and are suffering because of it.

Your quality of life should improve through investment. And your investments, generally speaking, should never be a source of paralyzing anxiety. If you put your heart and not your brain along with your money into the market, then you are only preparing your emotions for a rollercoaster ride. By the way, for which you may not be ready.

-

Consider creating your own NFTs

If you’re thinking about investing some money and seeing it grow, it might be worth considering creating your own NFTs. Even if you are not an artist, not a 3D model, and not a developer, there are ways to digitize a lot of goods. It’s like starting your own company instead of investing in someone else’s: you can experiment with out-of-the-box ideas in the hope of finding your own golden ticket. In this case, you need to clearly know how to promote your tokens. Who knows, maybe you will make the next Nyan Cat.