How to invest in NFT? You are not the first to ask this question. This is a relatively new direction and it is advantage in terms of investing, as it is not yet fully mastered by institutional investors. It gives private investors the opportunity to receive high returns.

For understanding: the capitalization of the NFT market in 2020 was $100 million, and in 2021 it is already $30 billion. For understanding: the capitalization of the NFT market in 2020 was $100 million, and in 2021 it is already $30 billion. If you already understand what is NFT and how you can make money on the non-fungible token market, then it’s time to think about investing in NFT more professionally.

Assess investment risks

How to invest in NFT without risks? When you start investing, remember that any investment involves certain risks. Diversification is the basic rule of investing. Have you ever wondered why you shouldn’t put all your eggs in one basket? Not all non-fungible tokens are successful. Diversifying your portfolio can improve your chances of investing successfully.

Choose an investment trading strategy

If you act blindly and make impulsive decisions when investing, you will lose money. To avoid it, investors develop an investment strategy.

An NFT investment trading strategy is an approach to research, find, buy and sell tokens, taking into account market conditions, recent trends and historical price developments, in order to generate investment returns. Remember that all of the following trading strategies must necessarily be combined with a full assessment of each project on social grounds and with the help of analytical services.

What are the investment strategies in the NFT?

There are many NFT investment strategies, which you can read about in a profile article. Some of them are taken from the traditional cryptocurrency market, and some of them are adapted specifically for this new market. In this article, we will point out just a few strategies that demonstrate the difference in approaches, risks, and payback horizon.

Long-term holding

This trading strategy is an investment with a long-term profit planning horizon. That is, in this case, you buy tokens with strong fundamentals and hold them for a long period, expecting a long-term increase in value. In the language of the cryptocurrency market, this tactic is called “hold”, and the investor himself is called a holder or hodler.

Flipping

The essence of the Flipping trading strategy is short-term trades, capitalizing on short-term market trends and hype. In this case, your quick reaction and sufficient orientation in the market to catch trends is important.

DCA Strategy

DCA (dollar cost average) refers to the division of an investment into several smaller investments of equal amounts, divided into equal periods of time.

The dollar-cost averaging strategy is suitable for any type of volatile investment. However, DCA for NFTs may be even more important. It is because non-fungible tokens are not comparable in terms of volatility and are unable to predict price movements. By doing so, this strategy will balance the purchase price and take advantage of mart downturns.

Other benefits:

- It avoids the risks associated with buying at the wrong time;

- It prevents investment decisions based on emotions;

- It is suitable for those who are interested in a long-term investment.

Follow news and events from the world of NFT

At the end of April 2022, Yuga Labs, the creators of Bored Ape Yacht Club announced the release of The Otherside metaverse and, in connection with this, a large-scale release of the native Ape token in the amount of 55,000 pieces. As a result, on May 1, when the sale began, the token trading volume reached a record high of $780 million. This is a good example of how to invest in NFTs if you follow the news in the market and know how to react very quickly to them.

So, in example, we see how the owners of the project have matured to promote the collection through informational opportunities. Here, the logic is simple: credible facts are generated that generate great interest. This ensures that the token sale is more likely to increase its price in the future. Why are they going to grow? Yes, the issuance of NFT is limited, that is, sooner or later it creates a shortage.

Follow the news of the cryptocurrency sector. Thanks to this, you follow a promising collection initially and import it cheaply.

Other investment strategies in NFT

In addition to the strategies above, there are many more. Here are a few:

⦁ Whale tracking from NFT. This type of research allows users to see which collections are being bought and sold by top investors. These participants only invest in high quality non-fungible tokens, their value will increase. Whales tend to have a lot of inside information. Thus, they will always be one step ahead of the entire market.

⦁ Upcoming airdrop of NFT projects. Check out all the upcoming sales that have been announced. It is extremely useful as it gives you an idea of what to expect so you start researching ahead of time. But remember not to miss the moment: the cryptomarket is constantly changing and is constantly flooded with new opportunities. It also lets you see what non-fungible tokens are on sale so you score a bargain if you act fast.

How to choose NFT investment strategy?

There are many NFT investment strategies, but there is no universal recipe for financial success – you must understand this. It is important to find your own trajectory that fits your expectations, capabilities and budget.

At the same time, it is important to set realistic expectations and not be disappointed when a token does not sell for the expected price. These projects are highly dependent on mart trends and marketing campaigns.

Another tip: don’t spend more than you can afford to lose. You shouldn’t spend more than 10-20% of your total portfolio value on a single investment. Non-fungible token is no exception.

Use methods for assessing the investment attractiveness of the NFTs

There are also many methods to assess the investment attractiveness of NFTs. And below we talk about the main ones. But we underline: it is necessary to evaluate not by a method but to evaluate a combination. As such, collect the entire image of the project as a mosaic. Only then you make an objective and analytically accurate assessment of prospects.

NFT Community Development Assessment Method

The community is the deciding factor for NFTs, as its size determines the number of users and potential buyers in the open mart. The bigger the community, the more people remember NFT. Therefore, it can help the collection attract more potential buyers. For example, the community of Azuki collection is tall and dynamic. Due to its size, a larger audience will learn about the collection. To determine the size of the project community, it is enough to visit the official pages of the social network and estimate the number of subscribers.

- The best collections have communities that have a life of their own. The worst collections have dead communities that no one cares about. When investing in cultural value, an important indicator of a project’s sustainability is community activity on Discord . Collections like mfers or Loot, communities are very actively discussing different directions of development.

- Another important factor to consider is the number of in the secondary saless. An abundance of tokens, combined with low bids or low buying activity, may indicate that supply is exceeding demand.

- You should also track the number of unique wallets that entered the market each day, week or month. Usually it allows you to accurately determine the total demand in the mart.

Method for estimating capital flows

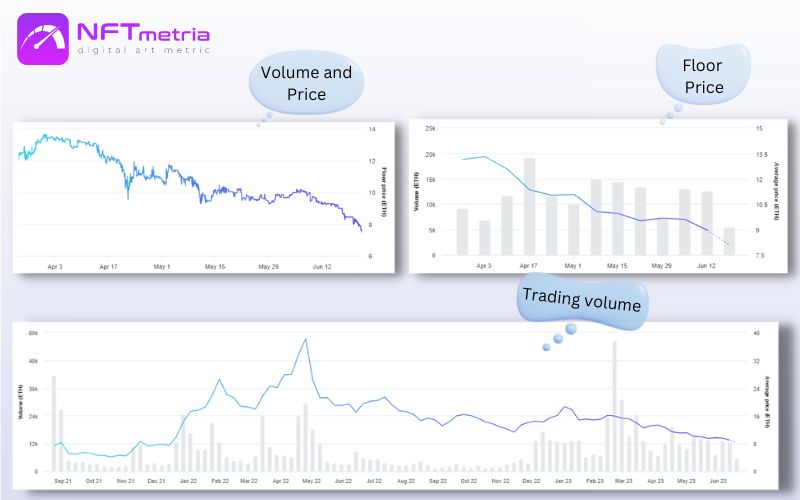

How to invest in NFT using sales figures? Marketplaces maintain open statistics on the sale and purchase of NFTs, which serve as a direct source of information on community activity and collection entries. This is the beauty of blockchain technology.

As an investor, what indicators should you pay attention to?

- Trading volume

By looking at the total trading volume, you easily determine if a collection is currently in demand. The higher the volume, the more liquid the mart. You need a liquid market so you can easily enter and exit NFT positions. - Sales Volume

This metric helps investors identify past and current interest in the collection. If the collection shows a lot of recent sales, it could be a sign of growing interest. However, one must consider the direction of movement relative to the minimum price. If many non-fungible token holders are selling and the floor price is falling, it could indicate waning interest or even panic selling.

Project evaluation method according to Whitepaper

Before thinking about how to investing in an project, we strongly recommend that you read its whitepaper that provides an overview of collection. A good formal report should define the objectives of the project and ideally give an idea of the following characteristics:

- The technology used (is the code open?);

- The use cases that the project wishes to develop;

- Update the roadmap and new features;

- Coin or token distribution and distribution program.

This information should be assessed in the context of the collection discussion. What are others saying about him? Are there any red flags? Are the goals realistic?

Methods for evaluating competing projects

A good official report should give us an idea of the use case the crypto asset is heading towards . At this stage, it is important to identify the collections with which it is in competition, as well as the existing infrastructures which it seeks to replace.

That is, the digital asset itself may look attractive at first glance, but when compared with other similar projects, you may come to the conclusion that this is a weaker investment option. It is important to be able to come to such conclusions before investing in a particular project, and not after!

Project evaluation method by team of creators

Behind all the high-profile PR and a beautiful picture there is always a team of real people who will implement everything that they promise their followers. Answer your own questions:

- Have the team members already had successful projects in this industry?

- Are they experienced enough to achieve the goal?

- Are they associated with suspicious collections or scams?

- Without a team, what does the developer community look like?

Often it is the big names in the team that ensure the success of the project. And vice versa – you should beware of projects that are created by persons previously seen in fraud.

Project tokenomics assessment method

To develop their own ecosystem, some projects issue a native token. It is a way of earning and a means of motivation in various subprojects. For example:

- PxN: Ghost Division collection has a $PXN token,

- CyberKongz has its $BANANA token,

- Kaiju Kingz has $RWASTE token.

In this case, you need to understand:

- What is the initial distribution of the token?

- What is its tokenomics?

- Does it have real value? The fact is that without having an objective value, it will not be liquid.

- Also pay attention to the ratio of groups in the distribution – if the team keeps a large percentage, then in the future it can manipulate this. As you can imagine, this is a bad sign.

Create conditions for investing in NFTs

There are many aspects and conditions to consider when investing in NFTs. But among them there are basic ones that you, as an investor, should start with. These are the fundamental aspects that concern security and your wallet:

- Choose a marketplace,

- Take into account commissions,

- Choose a reliable crypto wallet.

Choose a marketplace

Depending on your goals, you should also carefully consider the choice of a trading platform. Basically, we will distinguish 2 categories:

Mass market

These are such marketplaces that are aimed at a huge circle of people, and the main product on them is collections for every taste and budget. They host hundreds and sometimes thousands of collections of various types:

- PFP,

- Music,

- Trading cards,

- Virtual worlds,

- Membership,

- Gaming,

- Utility and so on.

For these types of sites, sales volumes and an even ratio of buyers and sellers are most important. Therefore, they have quite tough competition among themselves. For example, since the beginning of 2023, there has been an open struggle for leadership between Blur and OpenSea. Airdrops, more favorable conditions for minting, buying and selling, market discussions, influencer marketing, restrictive measures are being used.

In addition to the above sites, this category includes:

- Magic Eden,

- LooksRare,

- X2Y2 and so on.

Specialized marketplaces

There are also more specialized marketplaces on the market:

- Sports (for example, NBA Top Shot, NFL All day, LaLiGa),

- Musical (for example, Royal, which was founded by the musician 3LAU),

- Individual art 1/1 (for example, SuperRare).

When choosing a site, remember first and foremost about security – use only reliable, well-known sites with a proven reputation. And also keep in mind that each platform takes its own commission for transactions – either a fixed amount or a certain percentage.

Commissions

When making different types of transactions (minting, buying, selling, offer, transfer), the user pays a commission. And it exists of two types:

- Commission of trading platforms. When choosing a site, pay attention to this issue. The percentage is on average 0.5-5.

- Royalty. If a royalty (commission to the creator) is specified in the smart contract, then a percentage of the purchase will also be transferred to the author. The amounts are different – from 1 to 15%. The buyer does not pay this amount separately.

- Gas (commission for transactions in the blockchain). Decentralized blockchain technology implies payment for any action on the network. Depending on the blockchain and the load on the network, the gas varies. For example, on Ethereum, the amount can be both 100 and 1000 dollars (during the gas wars). And on Tron, this amount can be 5-10 dollars. Despite the cheapness of other blockchains, Ethereum remains the undisputed leader and 90% of the NFT market is focused on it.

Pay attention to the choice of cryptowallet

The crypto wallet is:

- Authorization method on most sites and platforms,

- Means of payment,

- Storage for your digital assets.

Therefore, it is necessary to take the choice of a crypto wallet for an investment portfolio as seriously as possible. An important point: the more blockchains, cryptocurrencies, token standards it supports, the better. So you will be more free in your investment activities.

Assess market trends

To invest competently, study trends, follow the cryptocurrency mart and consult experts.

In addition to external analysis, we recommend that you join the social communities of the project where you invest. Doing your own research can tell a good investment from a potential scam. This way you can also see the first signals from inside.

The best way to deal with mart volatility is to be well prepared. For example, in a bear market, when others begin to panic and make hasty decisions, you will be able to approach the problem rationally and be able to make a technical analysis of the situation.

And for a more professional investment activity, we advise you to take our free course of NFT investor. That’s where you are:

- Master all the basic concepts,

- Understand the structure, cycles and principles of the market,

- Get to know the various investment strategies in detail,

- Learn the mechanism of the NFT project life cycle,

- See how to build an NFT investment portfolio professionally.

- Consider promising new or proven projects with great investment potential.

When should you sell NFT and make a profit?

One of the most important things about investing is choosing the right time to sell. No one can accurately determine the asset’s maximum or minimum.

The maximum increase or decrease in the price of a cryptocurrency depends on the main players, but even they, with all their wishes, at certain times will not be able to predict the strength of the panic or active mood in the ranks of the general Public. Therefore, there is no need to wait for the minimum drop point and dream of instant growth to specific heights. As a beginner, it is better to take “above average” profits, otherwise you may not have time to sell your assets.

Conclusion

The value of NFT is largely determined by mart forces and it is not possible to accurately predict the future of the non-fungible token’s world.

However, your chances of success can be increased if you do proper market research and use the measures above. Use them to better assess and navigate the NFT space. Only in this way will you understand in detail how to invest in NFT.