NFT collections today are viewed not only from the point of view of collecting, but rather from the point of view of investment. If you are thinking about this question, we recommend you read our article How to start investing in NFTs. And if you have already learned the basics, then for you as an investor, after choosing and evaluating the collection itself, the question of differences within the project naturally arises: how to choose NFT for investment within the collection ? Which of them is more valuable? And how to define it?

Among the many parameters, there should be those rare ones that favorably distinguish the product from the mass. But how to choose NFT for investment from the entire collection, in which there are thousands of tokens?

How to choose NFTs for investment from the entire collection?

When we talk about crypto art Beeple, then there are few questions about the rarity of NFTs – it does not release large crypto collections from thousands of NFTs, but publishes a specific work in one copy. Therefore, the rarity of such works can be estimated in one expression – very rare and very expensive. But with art from crypto collections , it’s a little more complicated.

In our case, we consider the entire large collection, from which you have to choose exactly the token that will bring you X`s in the future.

NFT Investment Appraisal Criteria

We single out the following NFT evaluation criteria within the entire collection:

- Comments and mentions of a particular token in social networks and from various public sources,

- Analysis of the number and names of former token holders ,

- Newsbreaks and events in the world,

- Rarity of type, attributes and their combinations.

Let’s analyze each parameter in more detail.

Mentions of the NFT

Society is driven by the psychology of the masses, due to which social networks are so popular, and, in fact, you can sell anything on them, as well as create a brand and the public opinion you need. In our articles How to promote NFT and The best ways to promote NFT collection you can read exactly about the promotion in social networks.

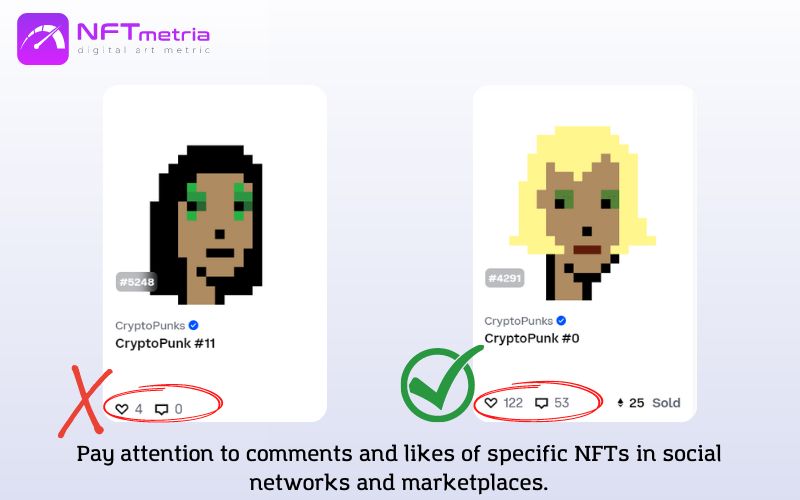

And it’s not just a theory. You can see social media discussions, mentions, retweets of certain NTFs even though there are hundreds or thousands of others in the collection. Some NFT marketplaces have also taken the path of social interaction among users and added the ability to leave comments and likes on specific tokens.

This way you can see which NFTs are popular and which don’t generate any reactions among the audience. For some, this is an insignificant accent, but to you, as an investor, any even small signals in society should turn into systemic monitoring and analytics.

Analysis of Former Token Holders

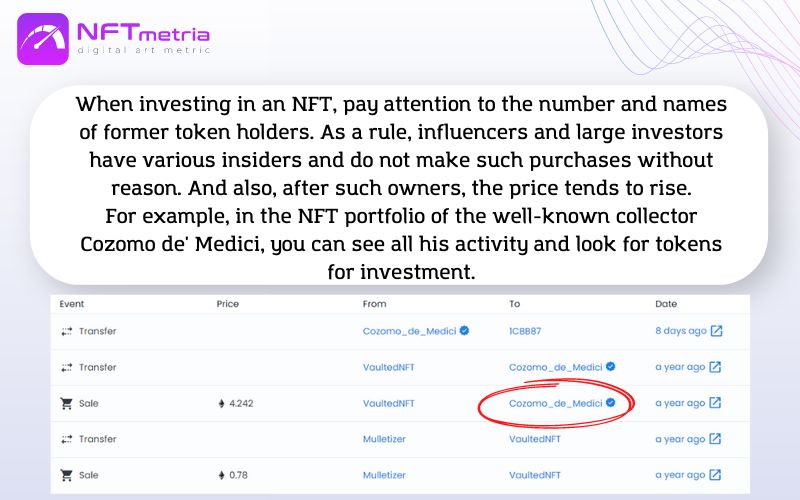

To answer the question How to choose an NFT, we propose to use the advantages of the blockchain to the maximum in your interests. In this case, we are interested in information on the history of ownership, namely:

- who owned,

- how long have you owned,

- how many holders there were.

All marketplaces have this functionality. We go into it and look:

- If there have been quite a lot of owners in a short history, then there are several options. If the owners are not interdependent, and there are no certain sequences in transactions, this may indicate healthy market transactions and the fictitious value of the token. And if you can still establish the real owner through social networks, then you have real market participants. And this is always a plus.

- If after the minute there were no transactions or there were only 1-2 of them, then the asset did not enter the market in the proper amount. The ideal ratio is when there are no late holders left. And the entire collection is on the market and on unrelated wallets. In this case, there is no possibility of manipulation. In addition, there is a pattern: the more an asset passes through the number of wallets, the more it has , the so-called fixed losses, the value of which is psychologically transferred to the asset.

- If the token often changes owners, but there are price drops in history, then this is a negative signal. No one will voluntarily lose their profits.

- If the token constantly changes hands, but with an increase in price, even if it is small, then this is a positive signal.

- If there is an influencer / well-known investor / prominent participant in the NFT market among the owners , then this is a positive signal for you. Professionals are less likely to fall to the bait of illiquid and unprofitable investments.

Events in society

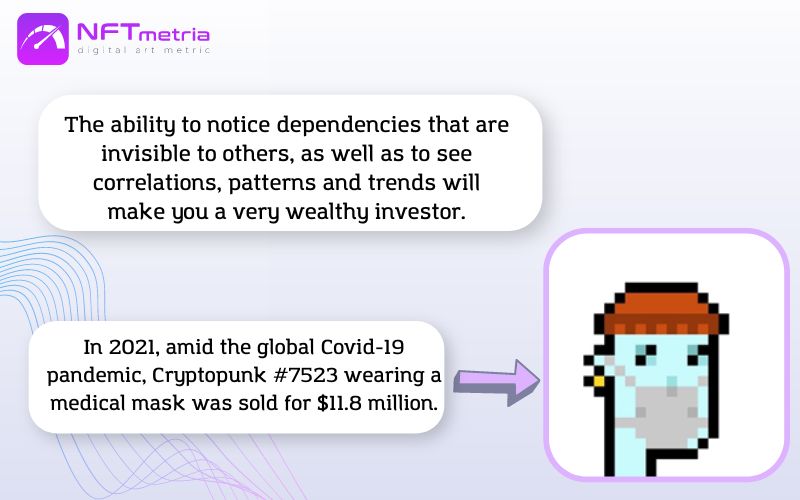

Any large-scale events leave their mark on any sphere of society. For example, Covid-19 forced the whole world to reconsider their attitude to viruses, personal hygiene. And also developed the labor market in terms of freelancing and remote work, completely turned the world economy around. We are talking about global relationships, but there are smaller ones that are reflected in the NFT market. For example, among 10,000 Cryptopunks. Do you know which token is one of the most expensive? “Covid” Cryptopunk #7523 wearing a medical mask, known as COVID Alien. He went under the hammer at Sotheby’s about $11.8 million.

Look for relationships and associations throughout the collection with the outside world.

How to choose NFT for investments? The ability to notice dependencies that are invisible to others, as well as to see correlations, patterns and trends will make you a very wealthy investor.

NFT rarity

Rarity determines the value of NFTs amid the flurry entering the market. In a situation with known people, objects, events – the rarity is easily superimposed on the entire collection. But when it comes to collections of NFTs with hundreds of pieces that have nothing to do with fame or popularity, the rarity of each feature within an NFT determines its individuality. Among the flow of visual information, there is a sign that noticeably distinguishes a particular work from others.

The rarity factor gives the NFT a greater intrinsic value among the entire collection, and the immutable proof of ownership gives the NFT owner a sense of distinction and exclusivity.

The rarity of NFT determines its value in the future.

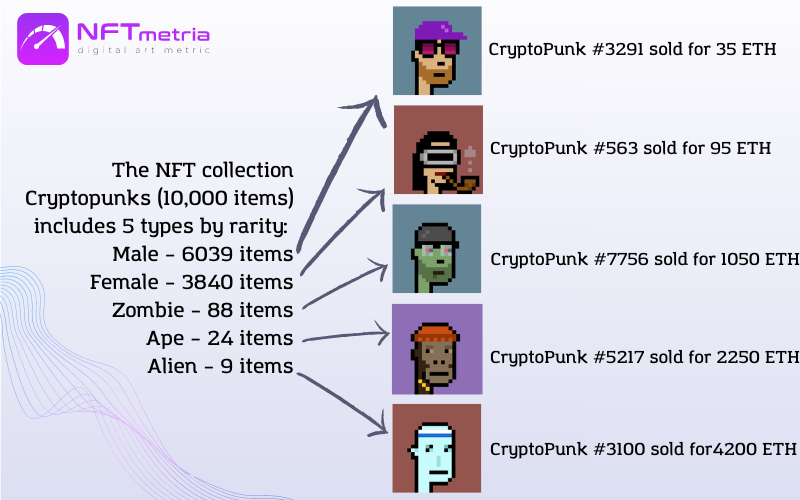

For example, the collectible hit CryptoPunks. The collection consists of 10,000 NFTs divided into five different “types”:

- Aliens – 9 pieces,

- Ape – 24 pieces,

- Zombie – 88 pieces,

- Female – 3840 pieces,

- Male – 6039 pieces.

Each type, in turn, has attributes or traits. The hat and necklace are extremely rare attributes, only 44 and 48 Punks have them. And other attributes are more common, for example, an earring is present in 2459 Punks, and a cigarette in 961 Punks. As you understand, the combination of type and attribute results in an estimate of the rarity of a particular NFT in the collection. And, accordingly, the price depends on it. And always a rare item will be more expensive than a more common one.

CryptoPunk #4434 (female) was sold about 57 ETH and CryptoPunk #7804 (Alien) was sold about 4200 ETH. Now you see why it is important to evaluate rarity when choosing NFTs to invest in?

How to choose NFTs for investment by rarity?

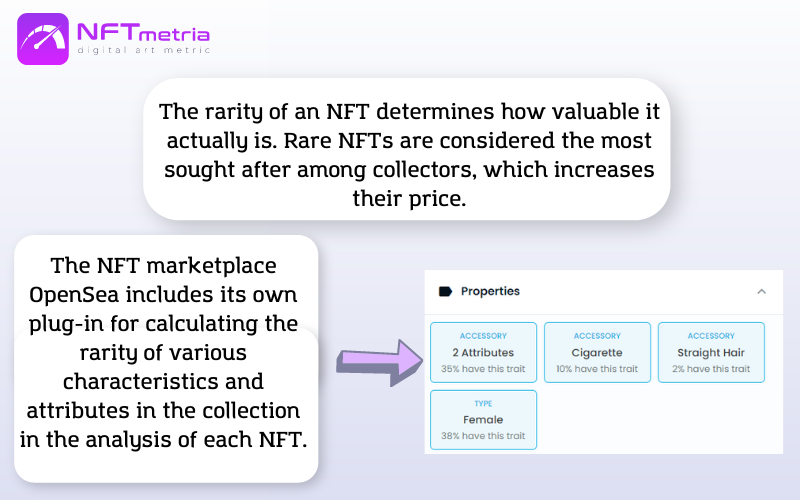

The rarity of NFTs has always been an extremely important and decisive factor when evaluating NFTs. According to some experts, this is the most important factor among all the others.

When comparing seemingly similar NFTs within the same collection, you can evaluate the rarity yourself using the built-in plugins on most marketplaces. For example, this interface is conveniently implemented on the OpenSea marketplace.

In addition, there are software tools for finding unique and rare features of NFTs. From the collection of NFTs with the same logic, they find those that, by certain parameters, characteristics, subtleties of execution, are inherent only to these NFTs. Perhaps these are not ordinary, strange, non-standard properties, but stand out from the general flow.

Editorial opinion

Investing in NFTs comes with a number of risks. And the question How to choose NFT is not simple and ambiguous. An investment evaluation of an NFT according to the above criteria is very important, but it does not guarantee you investment success. It is also important for you to decide on a trading investment strategy. And in general, before a deal, it is extremely important to conduct your own research and have a complete understanding of the market. It is these basic skills and knowledge at a fundamental level that we are ready to teach you in our author’s course.