In the ever-evolving landscape of digital assets, NFTs have emerged as a revolutionary concept, unlocking new avenues of value creation and ownership. Beyond their artistic and collectible allure, NFTs have transcended into the financial realm, giving rise to innovative mechanisms like NFT-backed lending. This article delves into the intriguing world of NFT collateralization, exploring the mechanisms that underpin NFT-backed loans and the transformative impact they bring to both the NFT ecosystem and traditional lending practices.

What is an NFT-secured lending facility?

The concept of NFT-backed loans is straightforward yet revolutionary. NFT holders can lock their tokens in smart contracts, which serve as collateral for the loan they seek. These smart contracts are executed on blockchain platforms, ensuring transparency, security, and trustlessness in the lending process. Once the loan is repaid with interest, the NFT collateral is returned to the borrower.

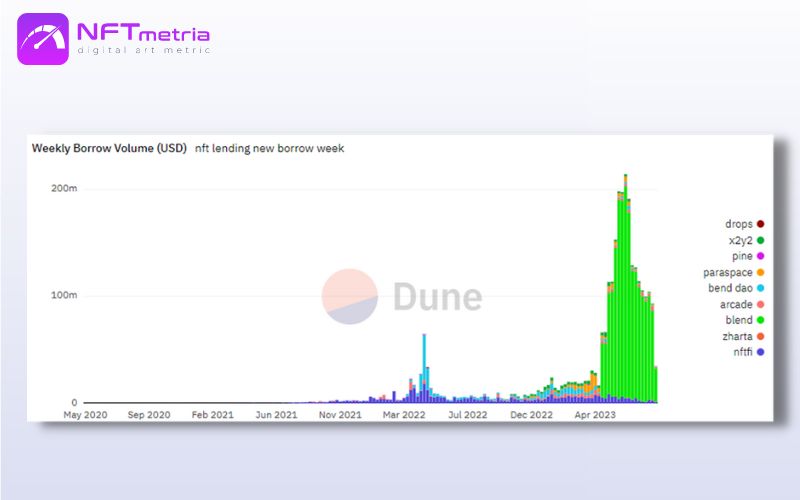

The NFT loan market is still in its nascent stage but has been gaining traction rapidly. To understand the prospects of the sphere: the volume of borrowing for the entire time is about 3 billion dollars. And this figure continues to grow inexorably.

Various decentralized platforms and protocols have emerged, facilitating the lending and borrowing of cryptocurrencies using NFTs as collateral. These platforms often provide options for lenders to stake their assets and earn interest, while borrowers can access immediate capital without selling their NFTs.

How does the NFT loan market look like?

To date, the most popular platforms for NFT loans are BendDao, NFTFi, Blend (by Blur marketplace), X2Y2, Arcade. After the launch of Blend, Blur attracted the attention of the entire market to this technology, and this is clearly reflected in the statistics: on average, the total amount of borrowings from each site ranges from $5 to $500 million, while for Blend this figure amounted to about $2 billion in less than six months. Just think about this number!

Below is a chart showing the Weekly Borrow Volume by platform.

There is an obvious favorite here – Blur (Blend). It seems, then why are other platforms needed if more than 95% of loans are taken on Blur? But in fact, everything is not so simple.

The next chart is the outstanding debt chart.

These are loans that users have already taken, but have not yet had time to return. Here the picture is completely different. Yes, Blur is in first place again, but already with a minimal lead. Why is that? Let’s talk about this in more detail later with examples.

What are the mechanisms of NFT lending?

To date, there are several mechanisms for lending secured by NFTs. Next, we will consider them in more detail.

Peer-to-Peer (P2P) NFT lending mechanism

Peer-to-Peer (P2P) is visually featured on NFTFi. This platform is an NFT pawnshop, where a borrower comes and looks at the conditions under which lenders are ready to lend him money secured by his unique digital asset.

Here’s how it works:

- For example, the lender is ready to issue a loan for 5 ETH for 30 days at 3%. A non-fungible token serves as collateral for obtaining a loan.

- If the borrower receives a loan (5 ETH) and then returns it within 30 days plus interest (0.15 ETH, that is, 3% of the collateral value), then the transaction has taken place – the owner gets back his asset, which he used as collateral.

- But if the borrower does not repay the debt, then the creditor takes the token for himself.

Pros and Cons of Peer-to-Peer (P2P) NFT Lending Mechanism

Of course, like any technology, the mechanism has obvious and non-obvious pros and cons, which we will describe in detail and in an accessible way below.

Benefits of Peer-to-Peer (P2P) Lending Mechanism

- A large set of NFT collections that can be given as collateral,

- If you have a rare NFT, you may be able to borrow a larger amount

- All conditions are known in advance (loan size, percentage, duration).

Disadvantages of Peer-to-Peer (P2P) Lending Mechanism

- If the borrower took a loan for 30 days and repaid it after 1 day, then he still has to pay interest for the entire period.

- If you have a rare token or it is not from a liquid collection, then it may take some time before a lender is willing to issue a loan of the size you need against the security of your asset.

Peer-to-Pool NFT lending mechanism

Such platforms operate on the principle of an automated NFT pawnshop, where the borrower, as a rule, takes an endless loan. But if the floor price of the NFT collection falls sharply, then the pawnshop will simply take your digital asset.

This facility provides greater liquidity and a variety of options for borrowers. Examples of Peer-to-Pool protocols: BendDao, ParaSpace.

Peer-to-Peer NFT Lending Facility with Perpetual Loans

Peer-to-Peer with perpetual loans is a separate mechanism for obtaining a loan secured by the NFT, which was invented by the well-known Blur.

By default, loans on Blur have a fixed interest rate and no repayment period. At first glance it sounds perfect, but there is a moment. Lenders can exit the position, that is, cancel the active loan and say that they no longer want to lend money against this NFT.

In this case, a Dutch auction is initiated to find a new creditor. In case of failure, the borrower is liquidated, and the lender receives ownership of the collateral.

Nuances of Peer-to-Peer lending on Blur

Due to the peculiarities of the mechanism, borrowers are afraid to take long-term loans on Blur, as lenders can change their mind and initiate an auction to find a new lender. And, if a new lender is not found, then the borrower will lose his digital asset. Because of this, we see very interesting statistics.

The average length of a loan is:

- Blur – 24 hours,

- NFTfi – 30 days,

- BendDao – more than 30 days.

The difference in performance in the charts above is due to the over 30x spread in loan duration between Blur and other platforms. That is, on Blur, users take out a lot of short-term loans, and therefore the weekly borrowing volume (graph 1) is significantly higher than on all other platforms. And the outstanding debt (graph 2) is at the same level.

Conclusion

NFT-backed loans introduce a novel way to unlock the value of NFTs while retaining ownership. They bridge the gap between the traditional financial system and the decentralized world of cryptocurrencies. As the NFT market grows and diversifies, so will the applications and potential of NFT-backed loans, revolutionizing how individuals interact with their digital assets and paving the way for a new era of decentralized finance.